■ Select From A Variety Of HMA® Monthly Contribution Plans: Build Your HMA® Medical Benefits From $2,500-$60,000 To Use On Most Of You And Your Family’s Out-Of-Pocket, Medical Needs That Are Not Covered By Your Health Insurance Or Medicare As Well As Any MD Elective Procedure That You Have Always Wanted Or Needed But Could Not Afford Before!

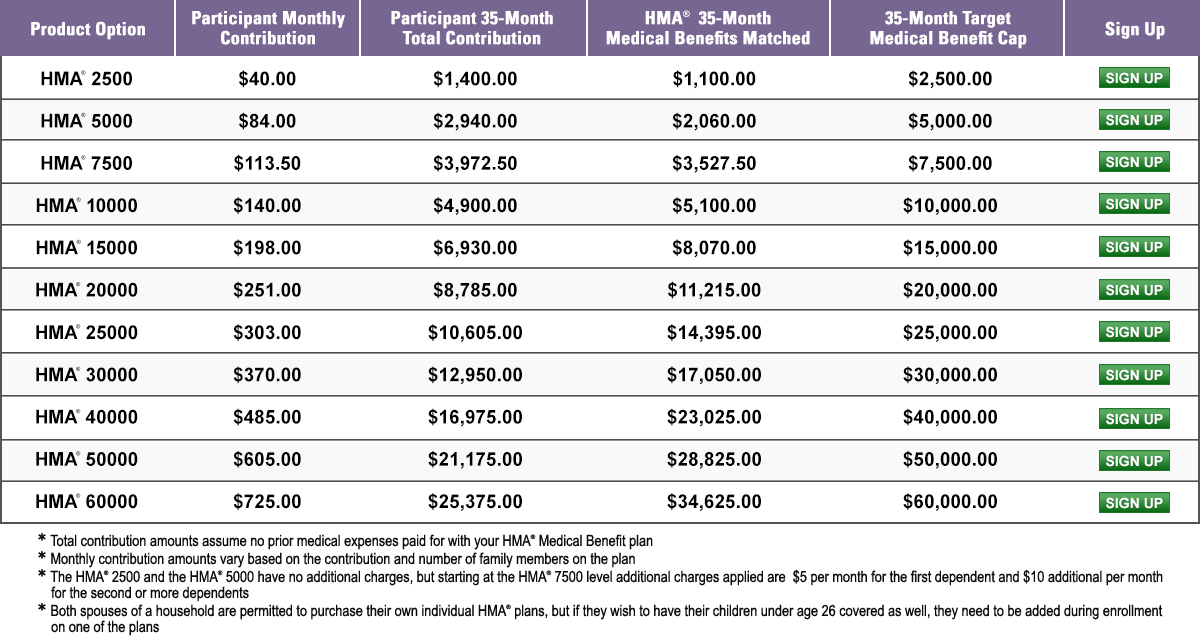

■ Flexible Monthly Payment Options: There Are 11 HMA® Product Options With Monthly Contribution Amounts Ranging From As Low As $40 Per Month To As Much As $725 Per Month That Will Fit Any Family’s Budget. You Also Have The Ability To Scale Up And Increase Your Monthly Contribution Amount At Any Time In Order To Secure Additional Medical Benefits And Protection For You And Your Family.

■ Enjoy Your Paid-Up Medical Benefits!: No Further Monthly, HMA® Medical Benefit Contributions Are Required Once Your Medical Benefits Reach Your Target Cap Amount (Only A Monthly Maintenance Fee Is Required). Over Time, You Can Also Gain The Ability To Significantly Reduce Your Health Insurance Monthly Premiums Because The HMA® Will Be Covering Most Of Your Potential, Out-Of-Pocket Obligations Not Covered By Health Insurance Or Medicare.

HMA® Contribution Options

Health Matching Account Services is the exclusive provider of the Health Matching Account (HMA®) product with monthly contribution plans that are all designed to build a significant medical savings plan for you to use to pay for most of your out-of-pocket, health care expenses that are not covered by your health insurance or Medicare. This includes your dental and vision expenses as well as health insurance copays, coinsurance and deductibles. In addition, because of how quickly your HMA® medical benefits can both grow and be replenished once you use it on a medical expense, you will also be empowered with more health care freedom and purchasing power than ever before. For example, by growing your HMA® medical benefits, you can have the ability to opt for the MD elective procedures that you always wanted or needed but could not previously afford such as lasik, plastic surgery, fertility procedures and so much more.

The 11 different HMA® plan monthly contribution options available will fit into any family’s budget and all contain a monthly, medical benefit matching schedule that is guaranteed to award you a match of up to $2 in medical benefits that month, which will be added to your current amount of HMA® medical benefits for every $1 above and beyond what you contribute into your plan every month as the program progresses. Each HMA® plan is designed to build up to a specific, target medical benefit cap of your choosing and create an invaluable, medical savings plan for you to greatly reduce most of your out-of-pocket, medical expense obligations. You will have the ability to grow your HMA® medical savings plan over time from as little as $2,500 in medical benefits to as much as $60,000 depending on which of the 11 different plan options that you choose.

Once you have reached your HMA® target medical benefit cap, which can happen in as little as 35 months, your HMA® plan is considered paid up, and you are no longer responsible for contributing the full amount every month towards your plan. You will only be paying a monthly maintenance fee to keep your HMA® in force until you pay for a subsequent medical expense with your HMA® Medical Benefit plan at your pharmacy or medical provider. This important paid-up incentive once you have reached your target medical benefit cap serves as a reward for your good health and will drastically decrease the monthly amount that you are contributing towards your HMA® plan on a monthly basis.

By building the amount of your medical benefits towards your target medical benefit cap, the HMA® can also potentially serve to drastically decrease the monthly amount that you are paying for your health insurance premiums by giving you the security and freedom over time to increase your major-medical health insurance plan deductibles and opt for a higher deductible plan. This will result in an even further reduction in your overall health care expenses thanks to the HMA®, which will help you to securely pay for most out-of-pocket, medical expense obligations that your health insurance or Medicare does not take care of.

The HMA® is not health insurance.