So, what can be done? One option is to buy down the deductible by paying a higher premium for less exposure. But people who try that often confront an unpleasant reality: the extra insurance you can obtain by buying down the deductible is the most expensive insurance there is. In fact, eventually you will reach a point where an extra dollar of coverage costs more than a dollar of premium.

There are two reasons for that. First, small dollar claims occur more often than large dollar claims. Second, there is an adverse selection effect. The people who are the most likely to want a lower deductible and who are the most willing to pay a steep price to get it are the ones who are the most likely to file claims. In other words, they are sicker than people who select high deductibles and bear the first-dollar risk themselves. Insurance companies know this and they price their policies accordingly.

A second option is to self-insure for the exposure under the deductible. For example, to protect yourself against the first $10,000 of medical expenses, you could put $10,000 in a dedicated account, such as a Health Savings Account. The problem is that most families don’t have the money to do that. And if they make small monthly deposits to an HSA, it will take a long time to fill the deductible amount – even if they stay healthy and don’t have any medical bills.

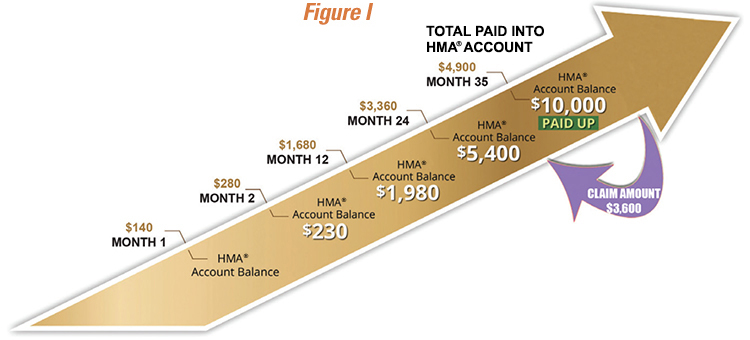

For example, assume that the family deposits $140 a month to the account. It will take three years to accumulate just half the amount of the deductible.

A third possibility is for people with high deductible plans to get together as a group and insure each other for the expenses under the deductible. This would be a separate insurance arrangement – completely detached from their primary insurance plan. But how can folks with no experience in the business pull that off? Fortunately, they don’t have to. As I explained in a recent post at Forbes, a Houston based firm called Health Matching Account Services is ready to do it for them with a brand-new insight: if you make monthly contributions to increase the amount of coverage you have, you can cover your deductible a lot faster than if you try to build up a cash account. What you get in return for your contributions is something akin to the Medigap insurance seniors buy to fill the gaps in Medicare.

Note: to avoid unwanted regulation, the company doesn’t call its product “insurance.” Instead, contributions are made to Health Matching Accounts (HMA®s). Moreover, unlike conventional insurance, these accounts don’t go away at year end. Provided there are no medical expenses, they keep on growing year after year. In other words, this type of insurance is always there until it’s used.

HMA®s also differ from conventional Health Savings Accounts in that the balance is available to pay medical bills. Money can never be withdrawn for non-health care purposes.

How Individuals Can Insure For A High Deductible

To continue with the above example, instead of putting $140 a month into a bank account, suppose people instead sent that money to an HMA® in the form of a contribution. After 12 months, they will have paid $1,680. For that amount, they will have coverage for the first $1,980 of medical expenses. In other words, the buyers are getting $1.17 of insurance for every $1.00 they pay in contributions, on the average. Things get better in year two (where you get more than $3 of coverage for every $1 contributed) and better still in year three (where you get almost $7 of coverage for every $1 contributed). After 35 months of contributions, people with no medical bills will have their own medical coverage that completely fills the $10,000 deductible gap. [See Figure I]

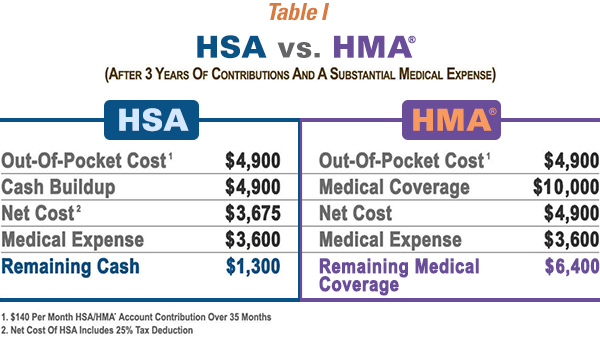

Would people have been better off putting those contributions in an HSA? The company gives this example. After 35 months, the total amount contributed will equal $4,900. So, the person with the HSA will have that much in the bank, but face $5,100 of exposure – should an expensive illness occur. By contrast, the person who paid HMA® contributions will have nothing in the bank but will have $10,000 of coverage and no remaining exposure. Now let’s suppose that a medical event occurs, costing $3,600. After the HSA holder pays this amount, they will have only $1,300 left in their HSA – according to the example the company provides. Since the HSA deposits are tax-advantaged, we could top up that amount to $2,525 (assuming a 25% tax bracket). But remember, if they try to withdraw the cash and spend on non-health consumption, they will pay taxes and penalties on the withdrawal. [See Table I]

Would people have been better off putting those contributions in an HSA? The company gives this example. After 35 months, the total amount contributed will equal $4,900. So, the person with the HSA will have that much in the bank, but face $5,100 of exposure – should an expensive illness occur. By contrast, the person who paid HMA® contributions will have nothing in the bank but will have $10,000 of coverage and no remaining exposure. Now let’s suppose that a medical event occurs, costing $3,600. After the HSA holder pays this amount, they will have only $1,300 left in their HSA – according to the example the company provides. Since the HSA deposits are tax-advantaged, we could top up that amount to $2,525 (assuming a 25% tax bracket). But remember, if they try to withdraw the cash and spend on non-health consumption, they will pay taxes and penalties on the withdrawal. [See Table I]

Meanwhile, the person contributing into the HMA® doesn’t get any tax relief, but they will still have $6,400 of medical coverage available. And, after only eight more months of contributions, they will have completely closed the $10,000 deductible gap once again. By the way, once an individual has achieved the $10,000 target level of coverage, they can maintain that level by making a modest payment of $40 per month. Going forward, they will have $10,000 of coverage for a price of roughly 5 cents on the dollar. Is this a good deal? If you tend to live paycheck-to-paycheck and have trouble saving for medical expenses, self-insuring against your deductible with an HMA® may make more sense than trying to fund it with a savings account.

Meanwhile, the person contributing into the HMA® doesn’t get any tax relief, but they will still have $6,400 of medical coverage available. And, after only eight more months of contributions, they will have completely closed the $10,000 deductible gap once again. By the way, once an individual has achieved the $10,000 target level of coverage, they can maintain that level by making a modest payment of $40 per month. Going forward, they will have $10,000 of coverage for a price of roughly 5 cents on the dollar. Is this a good deal? If you tend to live paycheck-to-paycheck and have trouble saving for medical expenses, self-insuring against your deductible with an HMA® may make more sense than trying to fund it with a savings account.

How Employers Can Insure for a High Deductible

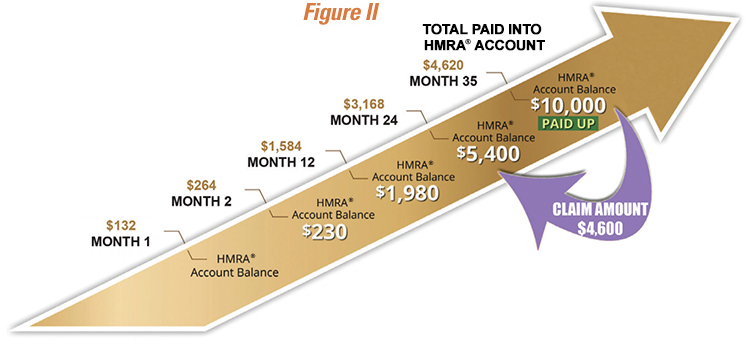

Consumer-driven health care generally refers to two kinds of health plans: Health Savings Account Plans and Health Reimbursement Accounts (HRAs). In the latter case, money is not usually put in the employee’s account. Instead, the employee incurs medical expenses that are reimbursed through (or paid through) the account. HRAs have the advantage of flexibility (no across-the-board deductible is required). But employees don’t get to keep the money they don’t spend on medical care. Take a look at Figure II.

In this example, the employer takes advantage of the premium savings from purchasing high-deductible, third-party insurance by choosing a $10,000-peremployee deductible for a group health insurance plan. If the employer is willing to give the employees first-dollar coverage under the plan, then the employer has $10,000 of exposure for each covered employee. As an alternative to self-insuring for this amount, the employer can be completely insured for the $10,000 deductible by making monthly payments of $132 for 35 months into the employer-owned Health Matching Reimbursement Account (HMRA®). As in the previous example, suppose there is a medical expense equal to roughly half the size of the deductible ($4,600). After the $4,600 claim is paid, the employer will have half the coverage remaining ($5,400). But full coverage ($10,000) can be restored after making monthly, $132 payments on that employee for only one more year.

In this example, the employer takes advantage of the premium savings from purchasing high-deductible, third-party insurance by choosing a $10,000-peremployee deductible for a group health insurance plan. If the employer is willing to give the employees first-dollar coverage under the plan, then the employer has $10,000 of exposure for each covered employee. As an alternative to self-insuring for this amount, the employer can be completely insured for the $10,000 deductible by making monthly payments of $132 for 35 months into the employer-owned Health Matching Reimbursement Account (HMRA®). As in the previous example, suppose there is a medical expense equal to roughly half the size of the deductible ($4,600). After the $4,600 claim is paid, the employer will have half the coverage remaining ($5,400). But full coverage ($10,000) can be restored after making monthly, $132 payments on that employee for only one more year.

Needed Policy Changes

As I wrote at the Health Affairs Blog, the tax law gives us a plethora of choices when it comes to medical savings and health insurance: HSAs, HRA, FSAs, etc. To that we can now add the very innovative HMA® account, courtesy of Health Matching Account Services. Unfortunately, the private sector must struggle with tax laws and regulatory regimes that look like they were designed with no thought at all. In a rational world, the tax law would provide a level playing field for premium payments and deposits to every type of medical savings account. On a level playing field, competition in a secondary insurance market would provide consumers with many choices. For example, some might prefer to self-insure for the first $3,000 and buy the kind of secondary medical coverage described above for the remaining $7,000 gap. Who knows? But for the perverse incentives of Obamacare and other insurance regulations, primary insurers might consider offering these types of choices. A secondary market for health insurance might not even be necessary.

6335 W Northwest Hwy – #2111 • Dallas, TX 75225 • email: info@goodmaninstitute.org • +1 214 302.0406

The Goodman Institute for Public Policy is a 501(c)(3) nonprofit organization and contributions are tax-deductible to the fullest extent of the law.

A tax receipt will be issued directly from the Goodman Institute within 2 business days after the receipt of your donation.